The OECD recommendations are divided into four parts.

- On fiscal policy. The two big conclusions are to reduce the deficit and try to make spending more efficient. Public debt has become high in recent years and, according to the OECD, borrowing should be reduced. Regarding the efficiency of expenses, the organization explains that in Latvia there are various possibilities to simply use existing funds more efficiently.

- About taxes. The OECD recommends revising the labor tax burden on low-wage earners in order to try to bring these workers out of the shadow economy, which is still at a very high level in Latvia. Experts recommend raising the real estate tax by updating it according to market values. However, tax relief should be provided for poorer households.

- Public sector. Experts point to the need to increase employees’ digital skills, develop IT systems. Also, this point includes a recommendation to establish mandatory income declaration for everyone. This has been discussed at the government level for a long time.

- About investments. The OECD emphasizes the need to strengthen the Competition Council, promote bank lending. The organization also recommends that Latvia accelerate the listing of large state-owned companies on the stock exchange, thus developing the weak capital market here. Latvia should also strengthen the Court of Economic Affairs both from the point of view of powers and resources.

Krišs Kairis: There are a lot of recommendations in the report, but what do you think is the most important?

Matthias Korman: I think Latvia needs to find ways to raise its labor productivity in order to be internationally competitive. Latvia must find a way to improve competition throughout the economy, revive the dynamism of business and ensure that the economy and people throughout Latvia really benefit from innovations and productivity improvements that help provide better job opportunities, increase incomes and living standards. And, of course, compared to other Baltic countries, Latvia has a high level of informal or shadow economy. Also, you have a relatively large public sector and there are opportunities to increase your efficiency.

In the context of pressure to spend more on health and education, defense and homeland security must ensure that spending is equally targeted and effective in other areas. And there is definitely room to do more.

Compared to other countries, taxes in Latvia are relatively lower, considering them as part of the gross domestic product. This means that there is money that could be raised to help finance part of these investments without reducing Latvia’s competitiveness.

Speaking of specific topics, the report states that Latvia needs to improve its fiscal discipline. In short, should we tighten our belts?

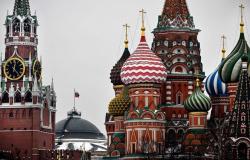

Historically, Latvia has had a strong fiscal position. We have gone through the pandemic, survived the economic and social consequences of Russia’s aggressive war against Ukraine. And they are certainly associated with high levels of government spending. On the permanent deficit trajectory we are on, of course the debt will continue to grow. And that is something that will have to be addressed.

We fully understand and appreciate that there are spending pressures, as I mentioned, related to defense and homeland security, as well as health and education, the green transition and energy security. But if you’re facing higher priority spending pressures, there are only a limited number of areas where you can find the resources you need. When you need to spend more on something, you need to spend less on something else. Do you need to increase your income or borrow? But if you borrow, it’s basically just deferred tax or deferred savings. So if you borrow to pay for your recurring expenses today, you’ll have to pay that money back at some point.

And that’s why we say – you have the opportunity to improve the efficiency of your spending in Latvia. There is an opportunity to evaluate the redistribution of expenses, for example, determining the priorities of expenses. There is an opportunity to organize part of the public sector administration. But tax revenues can also be increased, as their share of GDP in Latvia is obviously lower than the average. There is an opportunity to earn more revenue without reducing Latvia’s ability to be internationally competitive. And we would certainly recommend that you keep an eye on the fiscal position and make sure that you’re rebuilding your fiscal buffers and creating the fiscal space to deal with higher spending pressures in a number of these areas.

Your report also mentions that there is room for growth in the tax field in Latvia. What should be changed?

Well, I mean, labor income taxes. And there should be some reform in the tax and transfer system if you have very high social protection costs for low income earners. We believe this creates counterproductive, inhibiting factors.

There is an opportunity to increase revenues from labor income taxes. There is an opportunity to increase income from the property. There is also an opportunity to generate more revenue from environmental taxes, and this is also a way to accelerate the green transition.

Regarding property taxes – your system has quite outdated assessments. Here is an opportunity to update some of them and make sure they reflect actual market values.

The so-called shadow economy has poisoned Latvia for years. And your review mentions that it has not decreased in Latvia since 2012. Why?

I think it’s too expensive to move people from the shadow economy to the formal economy right now. You need to look at the interaction between the tax and transfer systems. I think that part of the social safety net should be financed more through a progressive income tax system rather than proportionately high fees. They are disproportionately high for low-income earners.

What happens in Latvia is that employees end up in the shadow economy, receive the minimum wage and then additional payments in cash outside the formal system. I think you can improve performance here by increasing tax collection. But changes are also needed systematically.

To address this, you need to make hiring more cost-effective officially. And when you bring more people into the formal system, you will also increase your level of government revenue. This is currently lost revenue for the government.

An important element here would be to adapt the system of social protection contributions and taxes to ensure a more appropriate balance between them.

Tags: Latvia review taxes order reduce shadow economy Article

-